The global e-car sales figures

With the surprising discontinuation of the e-car purchase premium at the end of 2023, enthusiasm in Germany for the electric car fizzled out almost overnight and registration figures shrank like snow in the spring sun. Is that the end of the e-car boom?

The most important things at a glance

- In Germany, the number of e-car registrations is collapsing, but new BEV sales are increasing throughout Europe.

- The British are the most willing e-car buyers and are overtaking the Germans.

- In Norway, many advantages such as the long-standing VAT reduction for e-mobilists disappeared at the beginning of the year.

- From a global perspective, e-mobility was a success story in the first quarter of 2024.

- In China, France, Great Britain and the USA, the number of registrations is increasing.

- Internationally, there are differences in the drive mix. In China, plug-in hybrids continue to be in high demand.

- Of all things, electric pioneer Tesla is weakening particularly badly in all world markets.

- Experts see a growing acceptance of e-mobility throughout Europe if purchase prices and ranges are right.

- 2024 will be a successful year for e-mobility, but not in Germany – that's what industry experts expect.

- So e-mobility is by no means at an end. In Germany, it is currently only taking a breath.

Slump in e-car registration figures in Germany

Registration figures in Germany fell well short of expectations in the first months of this year, although German buyers do not generally have anything against environmentally friendly drives. For the first three months of the year, the Federal Motor Transport Authority reports an increase of 4.4 percent above the same period last year for alternatively powered new cars (electric, hybrid, plug-in, fuel cell, gas, hydrogen). However, if you subtract gas-powered cars, there are 126,356 new cars, or 18.2 percent, that were equipped with an electric drive (electric, plug-in, fuel cell). The development has turned negative, as this figure is 4.5 percent below the first quarter of 2023.

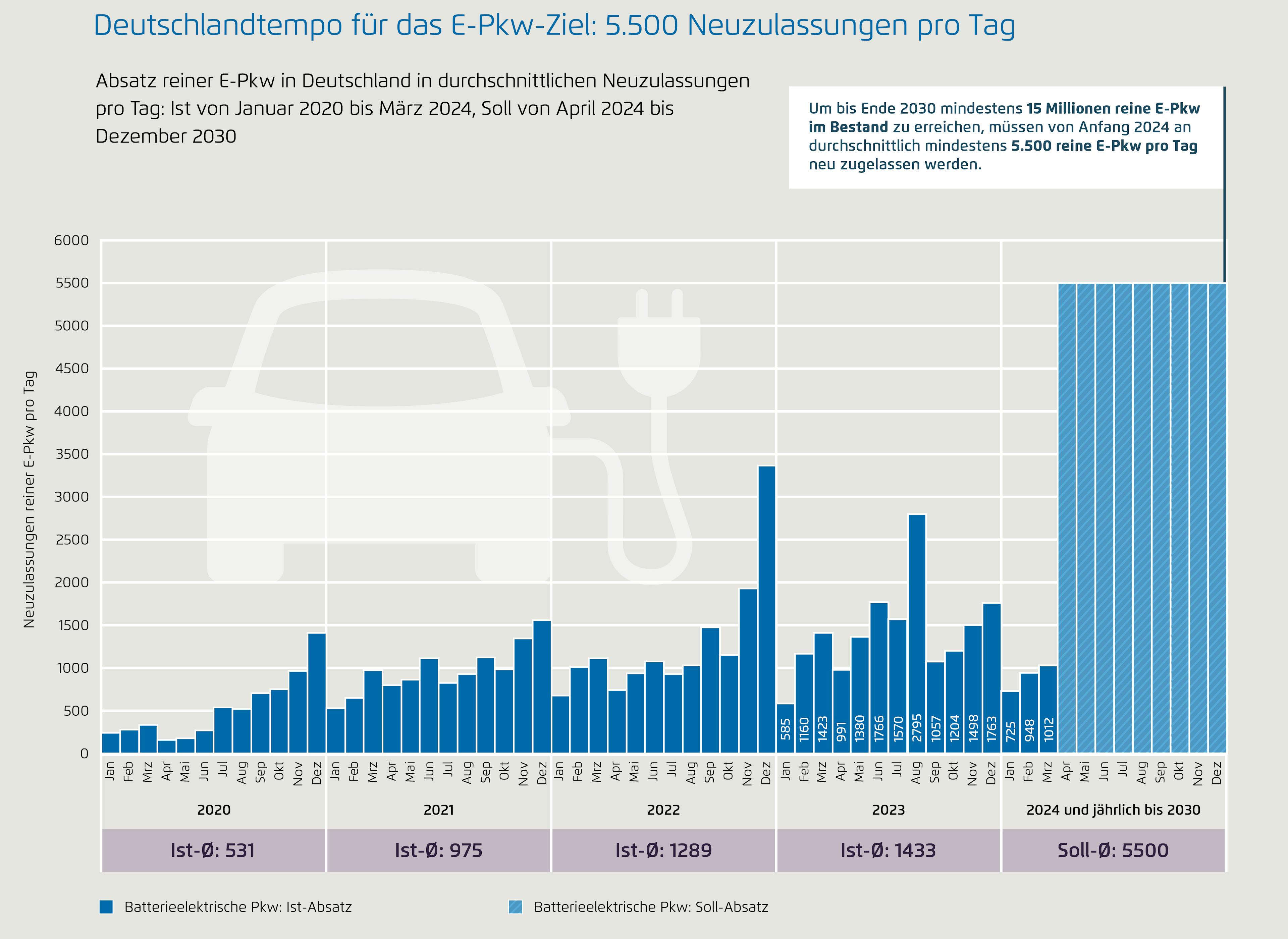

If you look at pure BEVs (Battery Electric Vehicles) with 81,337 new registrations from January to March, the e-car registration curve has taken a big dent despite minimal growth since February - minus 14.1 percent of new registrations are below the 2023 reference period. The electric car share of the new car market was only 11.7 percent in the first quarter.

The Tesla Model Y and the VW models ID.3 and ID.4 have been hit particularly hard. If the two Wolfsburg companies plummeted in buyer favor by 50 and 40 percent respectively, Tesla lost around 16 percent. As a consequence, VW has already partially suspended production at the end of 2023 and cancelled shifts at the Zwickau plant. However, it is not the case that customers are turning away from VW in principle. The Golf, like the Tiguan and Passat, sold splendidly in the first quarter of 2024, while the ID models developed into slow sellers.

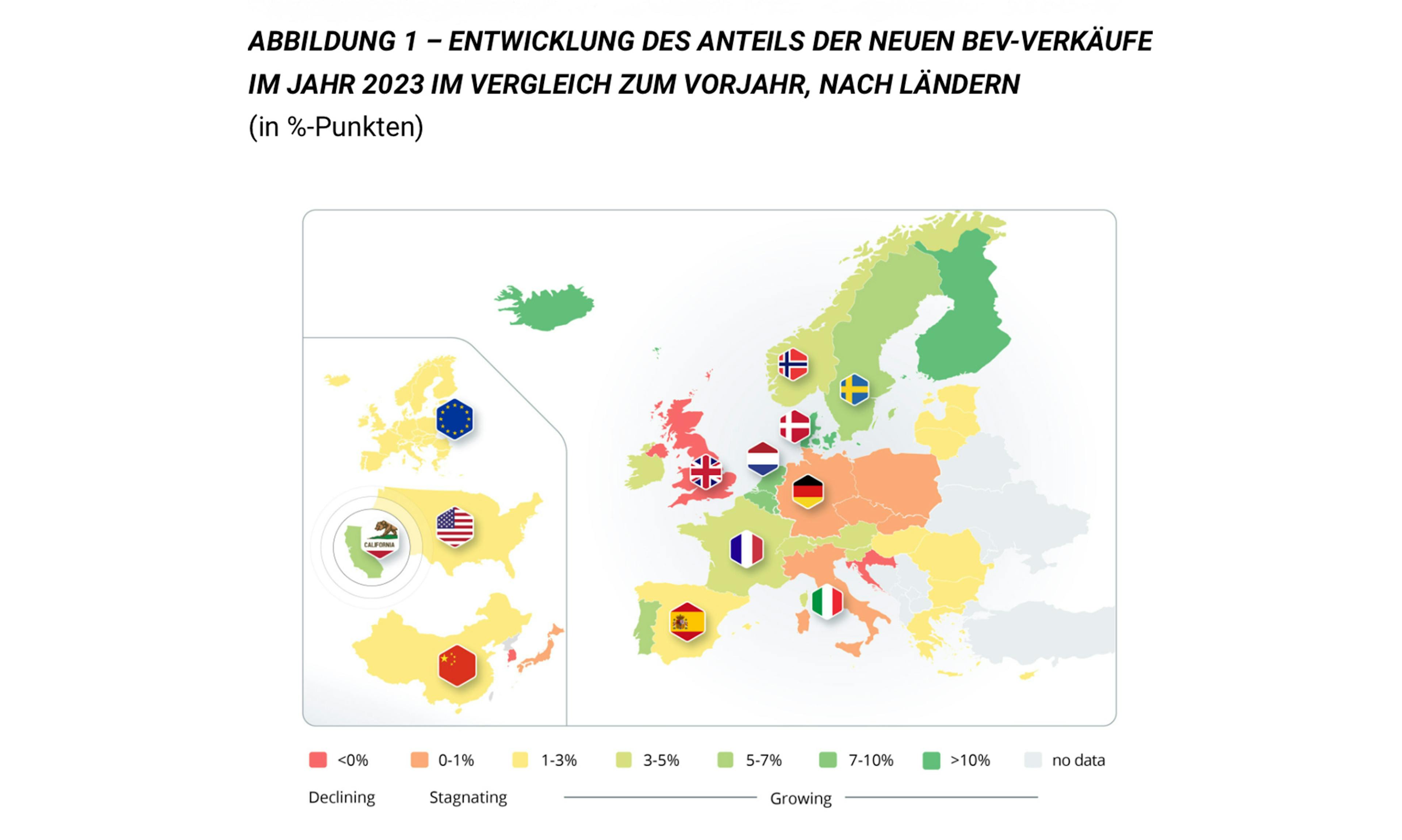

BEVs continue to grow across Europe – especially in France and the UK

In Europe, however, Germany is an exception. Other large car markets such as France are not experiencing any reluctance to buy e-cars. Registration figures grew sharply in some cases at the beginning of 2024, according to the Center of Automotive Management (CAM). In Great Britain, registration figures rose by eleven percent after a slump last year; An additional 84,000 new e-cars were put on the road here. The British are thus replacing the Germans as the most willing e-drivers in Europe. The French follow closely. Here, the number of registrations shot up by 24 percent. 80,000 new BEVs have been populating France's roads since the beginning of the year. So there can be no talk of a rejection of the electric drive among our neighbors.

As announced at the end of last year, the subsidy for the purchase of an electric car in France fell from up to 5,000 to 4,000 euros in mid-February. However, electromobility is not called into question because the reduction only affects the 50 percent of the French with the highest incomes. For all eligible cars, the premium will continue to be paid for cars with a list price of no more than 47,000 euros and a weight of 2.4 tonnes.

In Norway, the leading market for e-mobility, many advantages such as the long-standing VAT reduction for e-mobilists also disappeared at the beginning of the year. However, unlike in Germany, their expiry was announced for the long term and only caused a short-term and slight decline in BEV registrations. The consulting specialists at Berylls Strategy Advisors assume that the general upward trend in e-mobility in Norway will remain unbroken.

Compared to 2022, e-mobility developed positively in 2023 in the most important markets worldwide. Germany and Great Britain made little progress.

While Scandinavia and the Benelux countries, especially the Netherlands, are considered electric model countries, Southern and especially Eastern Europe are hardly developing. In Spain and Italy, minimal growth can be observed, but market penetration with BEVs is very low, with shares of the existing fleet of well below two percent. Growth this year is one to three percent, too little to be able to speak of success. In Poland, experts expect practically no growth at all for electric cars.

This is the situation in the car markets of China and the USA

From a global perspective, however, e-mobility is a success story. It is mainly written in China. The CAM forecasts a global sales volume of ten million electric cars for 2024, 60 percent of which will find their buyers in China alone. Here, the market will grow again, probably by 17 percent. This may sound huge compared to other markets, but in fact, electric car sales in China still increased by 21 percent in 2023. Apparently, the enthusiasm for e-cars is currently cooling down somewhat in the world's largest car market. But not for other forms of sustainable propulsion, because the numbers for plug-in hybrids (PHEVs) are rising steeply in China.

In China, France, Great Britain and the USA, the numbers are rising, but in the USA almost exclusively in California (plus six percent), in the rest of the country growth is only between one and three percent.

Internationally, there are differences in the drive mix. In China, plug-in hybrids continue to be in high demand, and in France and the UK, the numbers are also rising, so that the plug-in hybrid (PHEV) is growing faster than the purely electric car. For hybrids, experts expect growth of up to 40 percent. In large countries such as China and the USA, the PHEV apparently offers an increasingly welcome opportunity to drive electrically without having to worry about range.

Because the Americans are also turning to this form of drive, Ford and General Motors have already adjusted their production volumes, are scaling down electric car production and ramping up that of plug-ins. This development hits one electric car manufacturer particularly hard: Tesla.

Tesla no longer shines

Of all things, electric pioneer Tesla is weakening particularly badly in all world markets. An increasingly aging model range, frequent price reductions – most recently in mid-April – that make the residual values of used Tesla incalculable, and the lack of low-cost entry-level models are causing sales to plummet. In the last quarterly report, Elon Musk tried to reassure investors and announced cheap volume models. However, without giving details about technology or market launch. As a rule, many years pass between Tesla's initial announcement and market launch. Competitors like BYD, with a young and affordable model range, are finding it increasingly easy to make life difficult for Tesla – so far only in China. But BYD also wants to sell cars en masse in Europe. A goal that other Chinese manufacturers are also pursuing. Good news for customers in this case is a growing problem for all traditional manufacturers. They will lose market share.

In its home market, Tesla had its largest customer base in the coastal states, especially in California. Berylls Strategy Advisors expects a positive development in new electric car registrations for the Sunshine State in 2024 as well - but with lower growth compared to previous years. Seven to ten percent seem realistic. The fact that there are no more is mainly due to two circumstances: There is a lack of affordable entry-level models and charging facilities. But both must and will change, not only in California.

Experts see a growing acceptance of e-mobility throughout Europe if purchase prices and ranges are right. Alexander Timmer of Berylls-Partner says: "We are observing numerous signs that many Europeans are willing to consider an electric vehicle. It does not frighten them that the public BEV debate is still very controversial." However, the price has to be right.

Cheap e-cars desired

Bringing low-cost models to the market that match buyers' wishes is the biggest challenge for manufacturers. Almost all of them are working on corresponding cars. Citroën will offer the ë-C3 this year, Renault the electric 5. Dacia recently presented the new Spring, Mini the second generation of the electrified Cooper. Škoda comes with an as yet unnamed entry-level electric car, Fiat with the Pandina. They are all e-cars under 30,000 euros, many are even said to cost less than 25,000 euros. In 2025 – as the manufacturers have announced – the entry-level models Ford Puma Gen-E, Renault R4 and Twingo as well as the Cupra Raval and VW ID.2 siblings will come. Tesla, until recently still in talks with the Model 2, initially wanted to stop its development, but still wants to enter the development of low-cost volume models. However, it is completely open when these will be launched on the market. Autonomous robotaxes, on the other hand, are at the top of the agenda. It remains to be seen whether they will be able to iron out a dent in the e-car registration figures in the foreseeable future.

Despite slumps: 2024 will be a successful year for e-mobility

2024 will ultimately be a successful year for e-mobility, the industry experts assume. The biggest driver is China. In the USA, they expect only slight growth due to political uncertainty. In Europe, the signs are also pointing to growth, but not in Germany, where cars with gasoline engines in particular are increasing again in the registration statistics. This is not good news for German manufacturers, whose electric models are not very popular and in demand in China. Because although they have gasoline engines for the domestic market in a wide variety of variants in their range, they urgently need to sell more electric cars.

Manufacturers need successful e-mobility, otherwise there is a risk of fines

Because the CO2 limits for manufacturers will change in 2025, they are forced to help e-mobility succeed if they want to avoid fines. By the end of 2024, a manufacturer's models will only be allowed to emit an average of 115 grams of carbon dioxide per kilometer. From 2025, these emissions must be reduced to 98 grams, and by a further 50 percent from 2030. Without e-cars, which are included in these calculations as zero-emission vehicles, these reductions cannot be achieved. Manufacturers must therefore increase BEV sales figures strongly and quickly. They want to achieve this, for example, with cheaper leasing rates. Many manufacturers are also relying on reduced prices, special models or discounts on e-cars.

It can only be good for us customers if e-cars become cheaper and at the same time the range of cars on offer increases.

So e-mobility is by no means at an end. In Germany, it is currently only taking a breath for the final sprint in 2035. Opel provides proof of this. The brand with the (electric) lightning bolt in its logo made a very clear statement about the electric car in mid-April. It will convert the factory in Eisenach into an electric plant to produce the Grandland, Opel's largest SUV, for example. For the subsidiary brand of the Stellantis Group, this is an important step on the way to a CO2-neutral model range, which the EU requires from 2035.

From then on, only 100 percent emission-free cars will be newly registered in Europe. Despite all the discussions about synthetic fuels, these are likely to be e-cars. Which manufacturers will supply them and at what prices is still completely open. So the next eleven years promise to be really interesting for car fans.

Europe-wide growth of the charging infrastructure

If you look at the figures, the expansion of the charging infrastructure in Germany is a success story. In 2022, there were around 86,000 public chargers, last year this number rose to 121,000 (source: Berylls Strategy Advisors). Other large European nations are not so fast in building infrastructure. At first glance, Germany is in a very good position. However, the second place in the infrastructure ranking behind the Netherlands is deceptive. Compared to the Netherlands, which is much smaller in terms of area, the meshes of the charging infrastructure network in this country are much larger. Coverage, especially in rural areas, is still weak. The situation is very similar in France.

Number of charging stations in Europe in 2022/23

- Netherlands: 114,000/145,000

- Germany: 86,000/121,000

- France: 83,000/119,000

- Great Britain: 52,000/73,000

- Belgium: 28,000/44,000

- Italy: 31,000/41,000

- Sweden: 24,000/37,000

- Spain: 18,000/29,000

- Norway: 21,000/25,000

E-car model country Norway is a special case. In 2022, there were only 21,000 public charging stations there, which grew to just 25,000 units last year. However, the public charging infrastructure is less important here because many Norwegians can charge at the private wallbox (in Germany, about 71 percent of e-car owners have a private wallbox). And of course, the population of Norway (5.5 million) is also much smaller than that of Germany (just under 84 million). In Norway, around three million vehicles are currently registered, and BEVs now account for more than 82 percent of new registrations.